Is Nvidia the Future of AI or a Bubble Waiting to Burst?

Nvidia (NASDAQ: NVDA) has been on an incredible run since the start of 2023. The stock has risen around 700% and has been powered by impressive revenue and earnings growth along the way. A direct line can be drawn from this performance to artificial intelligence (AI) demand.

But when massive hype surrounds a technology, companies involved in it can be caught up in an investing bubble. When this bubble bursts, it could take years (or decades) to recover. So, is Nvidia the provider of the future? Or is it a bubble waiting to burst?

Could Nvidia be on the brink of collapse?

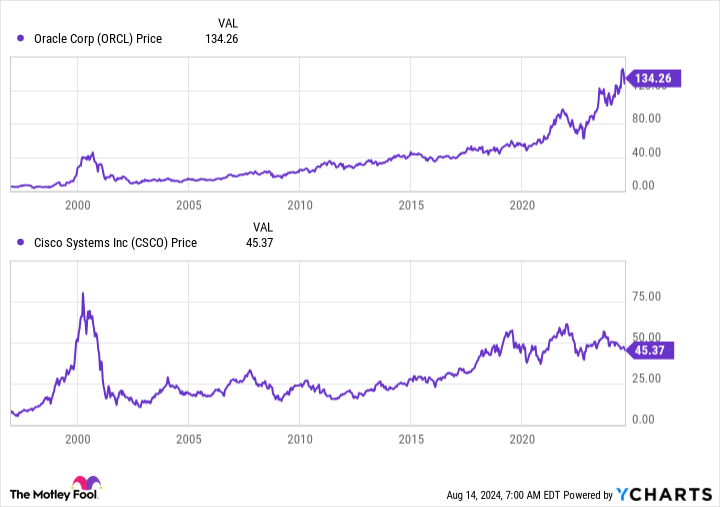

Perhaps the best comparison to today’s AI gold rush is the internet boom in the late 1990s and early 2000s. Companies like Cisco and Oracle were spearheading the stock market with the networking equipment needed to proliferate on the internet. However, that bubble burst, and it took Oracle nearly two decades to set a new high, while Cisco is still below its all-time high.

Could this be in Nvidia’s future?

One of the major differences between what happened in the early 2000s and what is happening now with AI is the speed of the buildout. The internet didn’t go up overnight, and the demand was less than expected. For Nvidia, which builds the graphics processing units (GPUs) that do the heavy lifting of AI model training, the demand does exceed expectations.

Nvidia is selling billions of dollars’ worth of GPUs every quarter, a number that has steadily risen over the past few quarters. Furthermore, with the big tech companies purchasing most of these GPUs and telling investors that 2025 will be another year of heavy capital expenditures due to building out the computing power needed for a leading AI model, Nvidia is likely in good shape from a demand perspective.

While the demand is there, the stock could still be considered overvalued and stuck in a bubble if the business can’t deliver enough growth. But is that the case?

Nvidia has premium margins that could come into question

Right now, Nvidia recently traded for about 68 times trailing earnings, which is very expensive. But that’s the wrong metric to use here because its business is rapidly evolving. Instead, I’ll use the forward earnings ratio (P/E), which uses analyst projections for the next 12 months. It isn’t perfect, but it provides a better picture because the market is a forward-looking machine.

From that perspective, Nvidia trades at about 43 times forward earnings. Which still isn’t cheap but isn’t as bad. By using those two metrics, investors can calculate that analysts project about 59% earnings growth over the next year.

Investors might look at the first quarter’s results and see 629% growth in earnings per share (EPS) and conclude that this will be a breeze, but that’s flawed thinking. Starting in the second quarter, Nvidia will be up against tougher year-over-year comparisons, which might not provide the same impressive growth figures investors have seen over the past year.

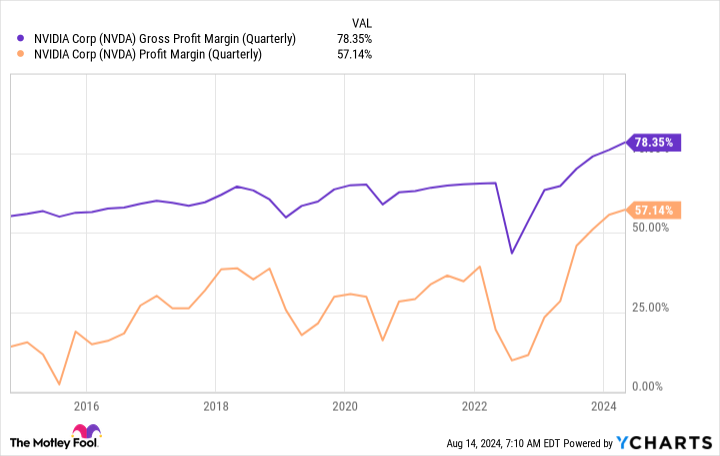

Furthermore, its profit margins are at unprecedented levels.

These are levels significantly above their historical ranges, which indicates that Nvidia can charge a premium for its products because it’s the industry leader. As big tech companies start to design their own hardware that can exceed Nvidia’s GPU performance on workloads specifically set up to be optimized on a custom chip, those margins could fall.

This has already begun, as Apple recently used Alphabet‘s tensor processing unit (TPU) to train its Apple Intelligence model.

But does this constitute a bubble? I don’t think so.

Nvidia is still delivering great products and strong growth, so it’s not a bubble. However, I think it will face increasingly harder challenges over the next year. I consider the stock expensive, with challenges on the horizon. It might overcome them and continue its historic run. Or it could get crushed. I’m not sure which of these outcomes will occur, so I will stay on the sideline for now.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Apple, and Nvidia. The Motley Fool has a disclosure policy.

Is Nvidia the Future of AI or a Bubble Waiting to Burst? was originally published by The Motley Fool