This Growth Stock Is Down 83%, but Billionaire Investors Are Scooping It Up. Is It a Buy?

Lyft (NASDAQ: LYFT), the No. 2 ride-sharing operator behind Uber Technologies, has burned nearly every investor who has bought the stock.

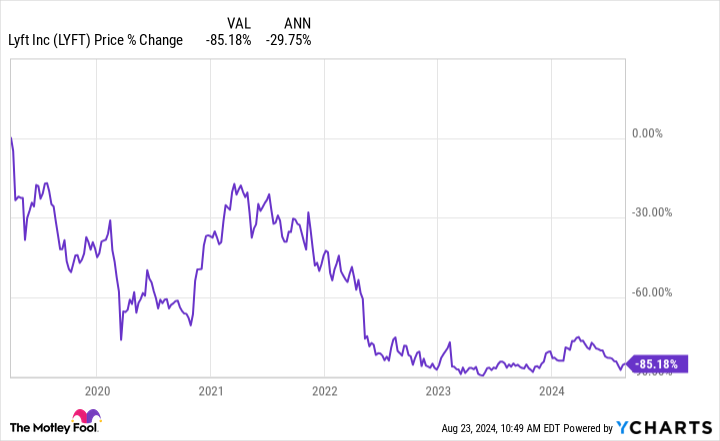

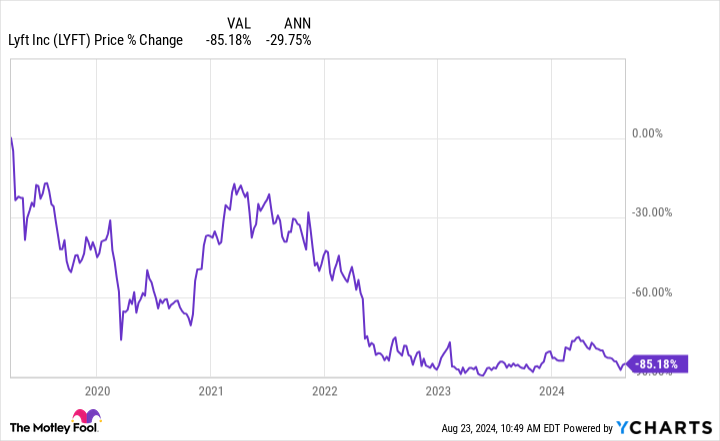

As you can see from the chart below, the stock is down sharply from its 2019 initial public offering (IPO).

Lyft stock has fallen in three separate episodes. First, the stock crashed after a successful IPO as investors believed the money-losing company was overvalued in 2019. The following year, it fell along with the rest of the stock market when the pandemic started, and after a recovery in 2021, the stock faded again in the bear market as its growth rates slowed.

However, there are signs that the stock is finally making a genuine turnaround. In the second quarter, the company reported its first-ever profit on a generally accepted accounting principles (GAAP) basis at $5 million and also reported surging revenue growth of 41% up to $1.4 billion on 17% gross bookings growth to $4 billion. That discrepancy is driven in part by growth in Lyft Media, its advertising business that delivered revenue growth of more than 70% in the quarter. New initiatives to increase its driver pool, speed up arrival time, and reduce the impact of prime time, or surge, pricing, are paying off.

Now, a number of billionaire investors seem to be taking notice as 13-F filings revealed some well-known investors bought shares of Lyft in the second quarter.

The smart money likes Lyft

David Tepper‘s Appaloosa Management is one of the most successful hedge funds in the world. The fund currently manages about $14 billion and counts Alibaba as its biggest holding.

Tepper is known for investing in distressed debt and deep-value stocks, which seems to explain his current interest in Chinese stocks like Alibaba, as well as Lyft, which is arguably a value stock. In fact, Lyft was Tepper’s biggest purchase during Q2 as Appaloosa bought 7.5 million shares of the stock in the quarter, bringing its stake in the company to nearly 8 million, which is worth roughly $100 million today.

Tepper hasn’t made public remarks on his Lyft purchase, but it’s worth noting that he added to his stake in Uber as well, buying 140,000 shares of that to bring his holdings of the ride-sharing leader to 1.5 million shares. Tepper has roughly equal stakes in Lyft and Uber, and he began buying shares of Uber in the second quarter of 2021, anticipating the turnaround in the ride-sharing leader. Tepper seems to be betting on a similar turnaround in Lyft.

Another billionaire who’s taken a shine to Lyft is Ken Griffin, whose Citadel Advisors hedge fund is one of the biggest hedge funds in the world, with assets under management of roughly $400 billion.

Griffin is known for using quantitative analysis and data-driven decision-making, and the company has thousands of positions in its fund. Lyft is a high-risk stock, but Citadel’s track record is impeccable as it’s considered the most profitable hedge fund of all time.

Citadel bought 4.4 million shares of Lyft in the second quarter, bringing its stake to 6.5 million shares, or roughly $75 million worth of the stock. Citadel had originally taken a stake in Lyft in the first quarter of 2019, so the company is sitting on some losses from that initial investment, but now looks like a better time to buy the stock.

Is Lyft a buy?

Lyft expects solid growth over the rest of the year, calling for a mid-teens increase in rides and gross bookings to grow slightly faster.

With the company finally shifting into profitability, tapping into new businesses like advertising, improving its product in a way that pleases both riders and drivers, and adding new features, the business looks to be headed in the right direction.

It’s rare to see two high-profile billionaire investors going after a beaten-down stock like Lyft, but the ride-sharing company has a lot of the hallmarks of a turnaround opportunity, including the beaten-down share price. If its current momentum continues, the stock looks likely to pay off.

Should you invest $1,000 in Lyft right now?

Before you buy stock in Lyft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lyft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Uber Technologies. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

This Growth Stock Is Down 83%, but Billionaire Investors Are Scooping It Up. Is It a Buy? was originally published by The Motley Fool